Page 66 - Book1E

P. 66

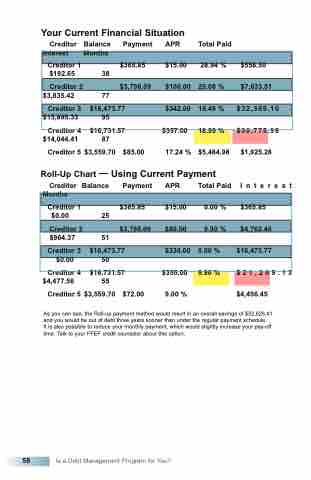

Your Current Financial Situation

Creditor Interest

Creditor 1 $192.65

Creditor 3 $15,895.33

Creditor 4 $14,044.41

Balance Payment Months

$365.85

$16,473.77 95

$16,731.57 87

APR $15.00

$342.00 $357.00

17.24 %

Total Paid 28.94 %

19.49 % 18.99 % $5,484.98

$558.50

$32,369.10 $30,775.98

$1,925.28

I n t e r e s t $365.85

$16,473.77

$21,209.13

$4,456.45

38

Creditor 2 $3,798.09 $100.00 25.08 % $7,633.51

$3,835.42 77

Creditor 5 $3,559.70 $85.00

Roll-Up Chart — Using Current Payment

Creditor Balance Payment APR Months

Total Paid 0.00 %

0.00 % 9.90 %

Creditor 1

$0.00 25

$365.85 $15.00

Creditor 2 $3,798.09 $80.00 9.90 % $4,762.46

$964.37 51

Creditor 3

$0.00 50

Creditor 4 $4,477.56

$16,731.57 $355.00 55

$16,473.77 $330.00

58

Is a Debt Management Program for You?

Creditor

5 $3,559.70 $72.00 9.00 %

As you can see, the Roll-up payment method would result in an overall savings of $32,626.41 and you would be out of debt three years sooner than under the regular payment schedule.

It is also possible to reduce your monthly payment, which would slightly increase your pay-off time. Talk to your FFEF credit counselor about this option.